Installment Loans

Access Up To $5,000 In As Little As 24 Hours

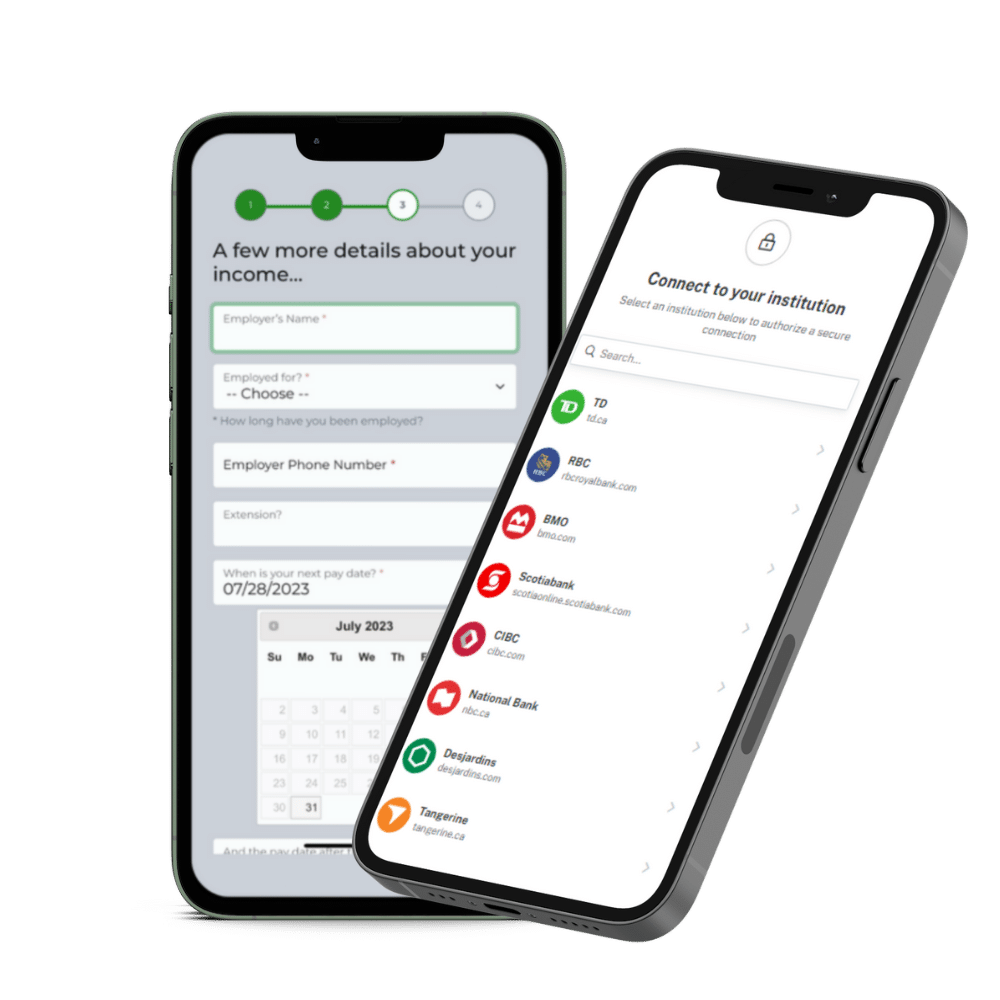

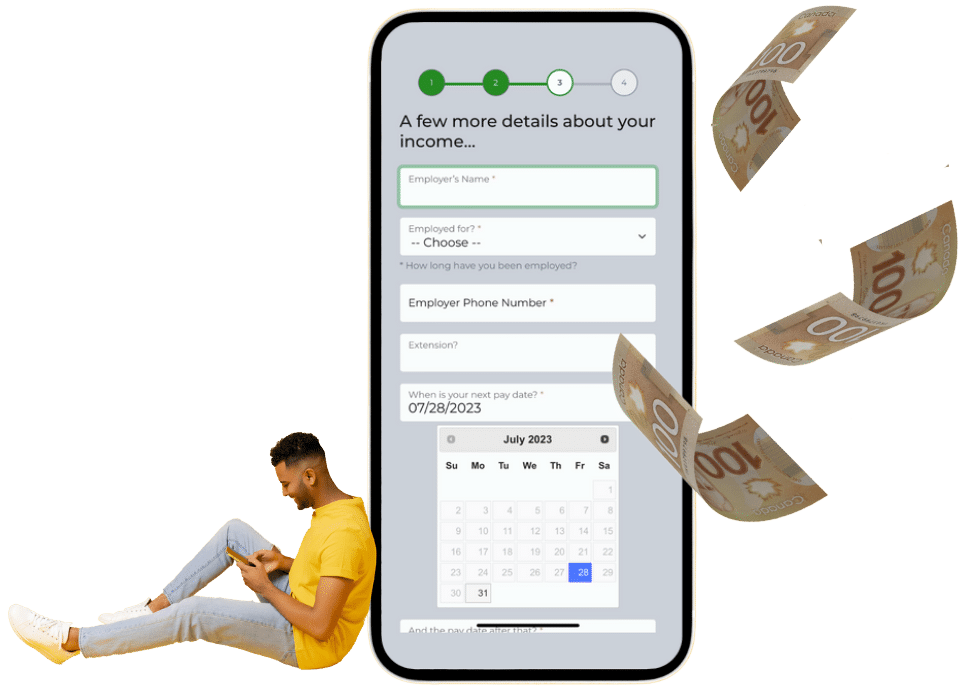

Our installment loans application process is simple and straightforward. With just a few clicks, you can instantly get matched and approved with a Canadian lender.

Apply Online

Fill out as many details as possible on your application to speed up the process and receive your money faster.

Verify Details

Upon pre-approval, you will be directed to a lender to verify your application details.

Review & Sign

Upon approval, review and sign loan offer from Lender.

Receive Money

Receive money VIA E-Transfer or direct deposit and make scheduled payments.

At Friendly Lender, we understand the importance of securing installment loans when you need it most. That’s why we have built a strong network of direct lenders across Canada to connect you with the right loan options. When you choose Friendly Lender, you benefit from the following advantages:

- Fast online application

- Access up to $5,000

- No credit checks *

- No documents required *

What are online installment loans?

An online installment loan in Canada is a type of personal loan that allows borrowers to receive a lump sum of money upfront, which is then repaid over a fixed period in regular, scheduled installments. These loans are typically unsecured, meaning they don’t require collateral, and the approval and application processes are often conducted online. Many lenders in our network do not require a credit check for installment loan approvals, but always check with the lender you are matched with.

How do I get installment loans?

You can get an installment loan by filling out our online application. When you fill out the Friendly Lender online application we put your application Infront of our network of 20+ Canadian lending companies, potentially increasing your approval odds. Don’t wait get started now!

Who is eligible for an installment loans?

Eligibility for an installment is subject to certain criteria designed to ensure responsible lending practices. To qualify for an installment loan, individuals must meet the following requirements:

Age Requirement: Applicants must be at least 18 years old to be eligible for an installment loan. This age criterion reflects the legal age for entering into financial contracts.

Active Bank Account: A crucial prerequisite for obtaining a installment is to have an active bank account. This ensures a secure and efficient process for loan disbursement and repayment.

Canadian Citizenship or Permanent Residency: To be eligible for an installment loan in Canada, applicants must be either Canadian citizens or permanent residents. This requirement is in place to adhere to regulatory standards.

Active Source of Income: Applicants need to demonstrate a reliable and active source of income. This could include employment income, government benefits, or other consistent sources of funds. This criterion ensures that borrowers have the means to repay the loan.

By meeting these eligibility criteria, individuals can confidently explore installment loan options as a potential solution to their short-term financial needs. It’s important to note that responsible borrowing practices contribute to a positive lending experience for both borrowers and lenders.

Loans range from $100-$5,000 with terms from 4 months to 24 Months or longer. APRs range from 29.99% to 46.96% and will depend on our partner’s assessment of your credit profile. For example, on a $1,000 loan paid monthly over 12 months at 29.99% APR, a person will pay $125.09 per month for a total of $1,501.08 over the course of the entire loan period. In the event of a missed payment an insufficient funds fee of around $45 may be charged (dependent on the lender).

What our customers our saying

Loans generally range in the area of $100 – $5,000. Dependent on the information in your application, the lender decides the amount you are qualified to receive. This amount is typically subject to increase as you successfully repay your online loans in the allotted time period.

Bad credit will not automatically disqualify you for a short-term loan. Lenders take various factors into consideration when they review and approve your loan application.

Upon approval, the majority of short-term online loans acquired through Friendly Lender are delivered to you electronically within a period of 24 hours, not including weekends or holidays.

Friendly Lender prides itself in delivering fast approvals because we understand the importance of receiving your loan rapidly in the event of financial emergencies.

Online lenders do not usually do a ‘hard’ credit check using credit bureaus, but will often ensure information provided is accurate through instant bank verification.

Are You Ready To Access Financial Support?

We connect your application with our network of Canadian lenders, giving you a high chance of getting approved.