Overview

Fast loans no credit check are intended to provide a short-term financial solution to individuals in Milton, Ontario. The high cost of living – particularly the cost of housing, groceries, and transportation – combined with low and stagnant wages have created a perfect economic storm for many Milton residents. Personal loans can help close a gap between paycheques and do not involve a credit check during the online application process.

Personal Loans: Who Can Benefit?

Personal loans can be typically used to cover almost any type of expense and are repaid over a series of installments, including any applicable interest and fees. Traditional banks and credit unions may require high credit scores in order to lend to borrowers. That is where online installment lenders step in, lowering the barrier of entry for subprime and near-prime borrowers.

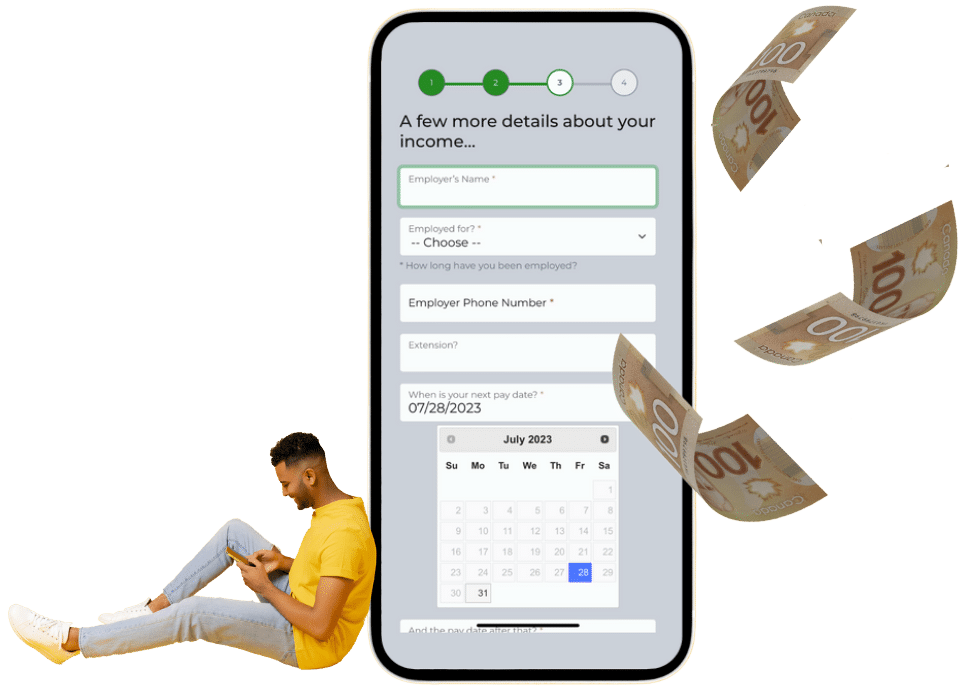

Here at Friendly Lender, we believe everyone deserves access to credit, including individuals with less-than-ideal credit scores. That’s why we don’t conduct a credit check during the simple and easy online application process. Apply online here.

Common Lending Requirements

Online installment lenders typically have fairly straightforward qualification criteria, such as the following:

- You must be at least 18 years of age or older.

- You must be a Canadian citizen or permanent resident.

- You must have a consistent income.

- You must have a permanent address.

- You must have a valid and active Canadian bank account.

Adhering to the above requirements may help optimize your chances of approval.

Below, let’s review the pros and cons of personal loans online.

Pros of Fast Loans No Credit Check

- Quick approval.

- Quick access to funds.

- No credit check during the online application process.

Cons of Fast Loans No Credit Check

- Higher credit risk may result in a higher interest rate and fees.

- Late or missed payments may result in additional charges and fees.

5 Tips to Improve Your Credit Score

Despite the persistent economic challenges in Milton, Ontario, there are potential ways you and I can improve our credit scores. Here are five smart tips:

- Sign up for Credit Verify. You will be able to monitor your credit health.

- Keep your credit utilization ratio below 30%.

- Pay off your credit card balances in full each month.

- Pay off your debts to lower your debt-to-income (DTI) ratio.

- Don’t max out your credit cards.

The above tips, while basic, may help guide you toward a better credit score over the long term.

5 Tips to Improve Your Finances

In addition to the above five tips to improve your credit score, let’s consider five potential strategies to improve our financial situation in Milton more generally:

- Increase your income by retraining for a new career, asking for a raise at your current job, or taking on a side hustle.

- Consider debt consolidation. This may help simplify your monthly debt payments and may result in a lower overall interest rate.

- Educate yourself on financial matters by reading blogs and books or taking online courses.

- Review your monthly spending and see where you can reduce your expenses.

- Set aside money regularly. Even $10 a month will make a difference.

Armed with the above tips, you may be better positioned to achieve a positive financial outcome. While Milton is facing challenging economic times, we must take advantage of the options that are available to us, however limited or imperfect.

Final Thoughts

Milton residents are confronted by many economic headwinds, which profoundly increase the uncertainty people feel in their daily lives. If you need quick funds in Milton, apply for a personal loan online via Friendly Lender. We don’t check your credit score or credit report during the simple and easy online application process. Intended as short-term financial assistance, the personal loans can help close a gap between paycheques.