Overview

Personal loans allow you to borrow a fixed amount of money, which you must pay back over a predetermined period. You must repay the loan in full, including any interest and fees. The repayment is made in a series of regular installments. Personal loans can be used to cover an extensive range of expenses, such as the following:

- Car repairs

- Rent

- Medical bills

- Emergency expenses

- Purchases

- Home renovations

- And more

You may obtain personal loans with traditional institutions like banks and credit unions. Alternatively, you may opt for online lenders. Online lenders may not look at your credit score or credit report, so even with a low credit score, you could qualify for a personal loan with an online lender. In the meantime, banks are unlikely to give loans to consumers with less-than-perfect credit scores. Therefore, online lenders often cater to an underserved and underbanked population.

In most cases, you would need to meet the following criteria to qualify for personal loans:

- 18 years old or older

- Canadian citizen or permanent resident

- Permanent address

- A proof of consistent income

- Must have a Canadian bank account that has been active for at least 90 days

Additionally, online lenders will be more disposed to give you a loan if you maintain the lowest possible number of NSF transactions and the lowest possible number of ongoing and active payday loans and short-term loans.

Before you take out a personal loan, make sure you can afford it. Look closely at the terms and conditions of your loan. The costs will include the amount borrowed, interest, and any applicable fees.

Online lenders in Canada must follow certain rules and regulations. If you have any questions or complaints, reach out to your lender or to the regulator in your province or territory.

Personal Loan Types

There exist many different types of loans for a variety of needs. For example, a co-signed loan allows someone to borrow money with a co-signer, who might possess higher creditworthiness. A buy now, pay later loan allows someone to make a purchase without paying the full price upfront. Otherwise, they might not have made the purchase. Discover the different types of personal loans that are out there.

Unsecured Personal Loans

An unsecured personal loan allows you to borrow money without providing collateral. If you default on your payments, you will not risk losing whatever asset you provided as collateral. Most personal loans are unsecured.

Secured Personal Loans

Secured personal loans require that you provide an asset as possible collateral. If you default, you risk losing the asset that you provided as collateral. However, the benefit of this type of loan is that the lender may be willing to lower your interest rate due to lower risk.

Debt Consolidation Loans

These are used to consolidate multiple different debts into one, allowing you to focus on a single monthly payment, possibly at a lower interest rate.

Co-Signed and Joint Loans

If you are unable to secure funds on your own, possibly due to a low credit score or the absence of a credit history, a co-signer with a higher credit score can help you access those funds or that loan.

Fixed-Rate Loans

The vast majority of personal loans are fixed-rate loans, meaning that the interest rate remains the same throughout the repayment period.

Variable-Rate Loans

The disadvantage of a variable rate is that it may increase during the repayment period due to changing market conditions. The advantage is that it may also decrease during favourable market conditions. It’s best to pay off this type of personal loan in the short term to avoid a sudden rise in the interest rate.

Buy Now, Pay Later Loans

Buy now, pay later loans allow you to make a purchase without paying the full price right away. The remaining balance is paid in several installments, typically within six weeks of the original purchase.

Personal Lines of Credit

Similar to credit cards, personal lines of credit allow you to borrow money on a revolving basis. Personal lines of credit are best for large and/or ongoing expenses, such as a major house renovation or an ongoing emergency situation.

How to Apply for a Personal Loan

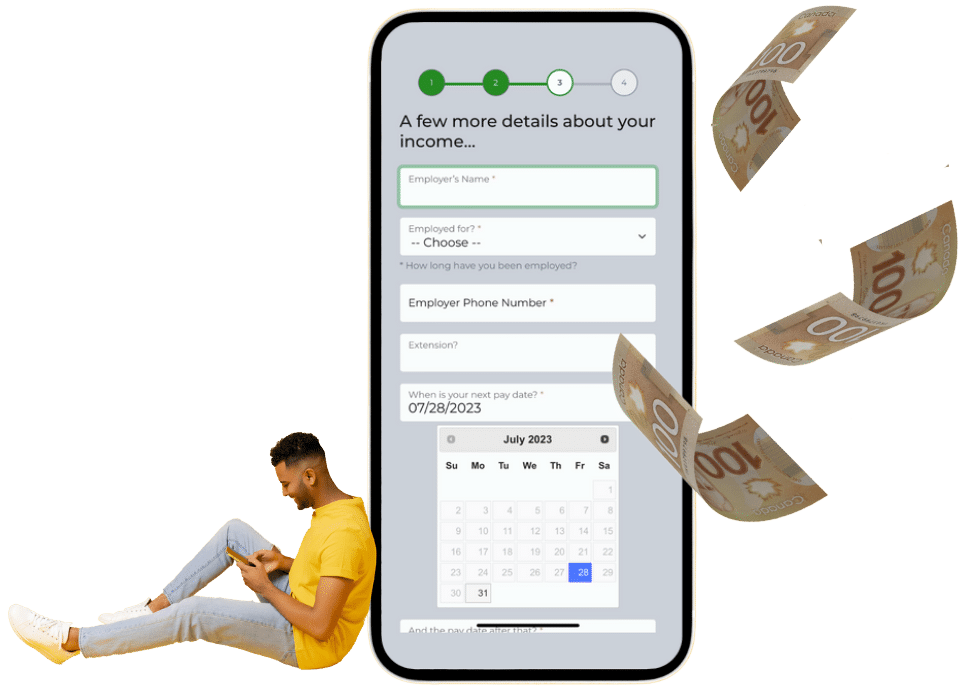

Looking for an unsecured, fixed-interest personal loan in Canada? Apply online via Friendly Lender! The online application process has never been simpler. Follow the below steps to apply for an online personal loan via Friendly Lender:

- Complete your online application.

- Get approved and get your funds deposited as soon as the next day!

Obtain Your Personal Loan in Canada Today

Friendly Lender is happy to link you up with online lenders in Toronto, Oakville, Hamilton, London, Guelph, Ottawa, Windsor, Markham, Oshawa, Kitchener, Cambridge, Niagara Falls, Brantford, Bowmanville, Barrie, Brampton, Richmond Hill, and other cities throughout Ontario. You can also get personal loans in Nova Scotia, Saskatchewan, Alberta, and other Canadian provinces. Apply online via Friendly Lender. The online application process is simple and easy and only takes a few minutes.