Personal loans and credit cards are two different types of credit that cater to different needs in the market. Those who do not have access to more traditional financial services may benefit from personal loans with online lenders. In this article, we will explore the differences between the two types of financial services in more depth.

Personal Loans: Overview

- A personal loan represents a fixed amount of money and a one-time payment that you must repay in several installments.

- You must pay the personal loan back in full, including any applicable interest and fees.

- Each Canadian province has rules and regulations that cover online lenders in that province. Make sure you deal with a responsible lender.

- Online personal loans can be used to cover a wide range of expenses, including rent, utilities, mortgage payments, groceries, car repairs, medical bills, and more.

Credit Cards: Overview

- A credit card is a revolving type of credit meant for everyday expenses. This means you can repeatedly borrow money against a certain available limit.

- You have to pay your credit card balance at the end of each month.

- If you do not pay the balance at the end of each month, you will be charged additional fees and penalties.

- If you only make the minimum payments on your credit card, it may result in higher interest and fees.

- The credit utilization ratio represents the amount you spend on your credit card versus the amount you have available to spend. If you maintain a low credit utilization ratio (below 30%), it will positively impact your credit score. This may help you with rental and/or mortgage applications and accessing other important financial services. You may also be able to obtain loans on more favourable terms – such as lower interest rates – if you have a higher credit score.

Soft Credit Check vs. Hard Credit Check

When applying for any type of credit, you must understand the impact it may have on your credit score and credit report.

- A soft credit check has no impact on your credit score and credit report.

- A hard credit check has an impact on your credit score and appears on your credit report.

- A credit card company may perform a soft credit inquiry to determine whether they should offer you a promotional offer and a hard credit inquiry before finalizing or approving your application for said service or offer.

- Most of the lenders we work with do not check your credit score. If a lender checks your credit score, it is usually a soft credit inquiry, meaning that it has no impact on your credit score or credit report.

Personal Loans vs. Credit Cards: Which Is Right for You?

- Those who do not have access to traditional financial services may benefit from online personal loans. Online lenders may work with people who have less-than-perfect credit histories.

- Those who want to build a better credit score may benefit from credit cards, provided that they make their payments on time and maintain a low credit utilization ratio (below 30%). If you wish to improve your credit score, consider registering with Credit Verify! The registration process takes only a few minutes, and you will be able to track your credit score and detect any mistakes on your credit report.

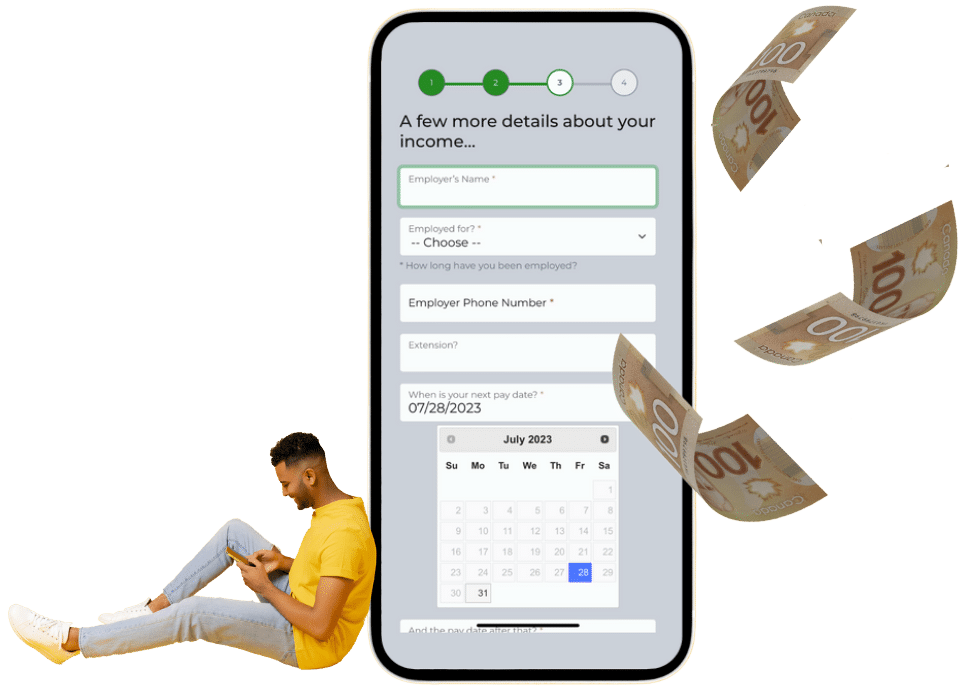

- Those who need to cover unforeseen or urgent expenses may benefit from online personal loans.

Conclusion

We hope that this article has given you some additional insight on personal loans and credit cards. The type of credit you use will depend on your unique financial situation. If you need a personal loan, apply online via Friendly Lender. We don’t check your credit score during our simple online application process. Even with a less-than-stellar credit history, you may qualify for online personal loans!