Intro

Nova Scotia is the seventh most populous province in Canada with fewer than one million residents. It is also the second smallest in terms of its land area and the second most densely populated province in Canada.

As of 2023, the living wage in Halifax, Nova Scotia’s capital, was estimated at $26.50 per hour. The corresponding living wage for Cape Breton was estimated at $22.85 per hour. Both the lower and upper end of this range far exceed the minimum wage in this province, which is just $15.20 per hour.

In addition to low wages, many are struggling with the soaring costs of groceries, housing, and other everyday necessities. Although the province may not be as expensive as Ontario or British Columbia, this does not mean that life is easy for Nova Scotians.

Get a Personal Loan in Nova Scotia

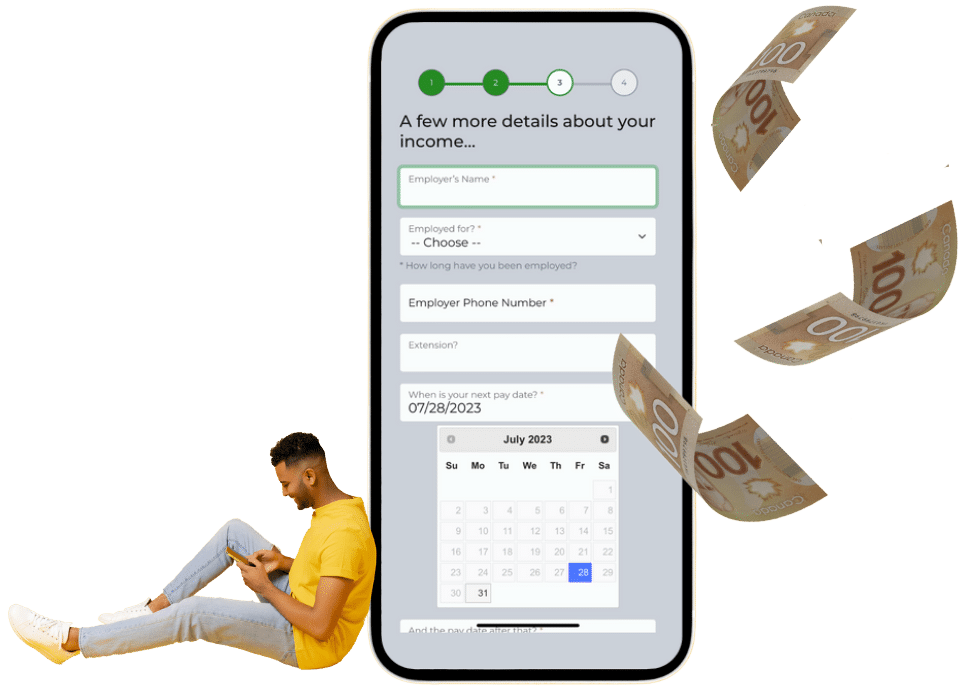

When you need emergency financial assistance, a personal loan in Nova Scotia can help! Just submit a quick online application via Friendly Lender. Even if you have a bad credit score, you might still get approved! We do not check your credit score or credit report during our online application process.

Tips to Get a Personal Loan in Nova Scotia

There are some basic requirements you need to meet to qualify for a personal loan in Nova Scotia, like the following:

- Must be 18 years of age or older

- Must be a Canadian citizen or permanent resident

- Must have a Canadian bank account that has been active for at least 90 days

- Must have a permanent address

- Must have a steady income

In addition, the following tips will help you land that personal loan:

- Minimize NSF transactions

- Minimize the number of current payday loans or short-term loans

You also must have one of the following sources of income:

- Employment income

- Self-employment income

- Government benefits

If you meet the requirements, you are much more likely to receive a personal loan in Nova Scotia. Apply online today!

Instant Bank Verification (IBV) for Personal Loans in Nova Scotia

Online lenders may use Instant Bank Verification (IBV) to verify bank account and application details to make sure that the funds reach the correct person and evaluate your eligibility for personal loans in Nova Scotia.

Financial Tips for Nova Scotians

You can follow some basic principles to help improve your financial health in this province:

- Have a plan. You can’t hit a target you don’t see. Decide on your savings targets, desired income level, and debt repayment strategy. Once you have a clear plan, take incremental steps to achieve each of the goals on your list.

- Follow a budget. You can use a budget like 50/30/20. The 50/30/20 budget has you allocating 50% of your income toward necessary expenses, 30% toward wants, and 20% toward savings and debt repayment. Following this strategy, you will begin to optimize your financial wellness in no time.

- Build emergency savings. Statistics show that one in four Canadians are unable to cover an unexpected expense of $500. You need at least three months’ expenses saved up in order to cover unforeseen emergencies like a job loss or a health crisis. Start building your emergency fund today to help you deal with unexpected setbacks. You can also check your credit score at Credit Verify to help you monitor your financial health.

These are just some of the tips you can follow to help optimize your financial wellness. Financial wellness is a lifelong journey, not a quick fix, and requires consistent effort.

Need a No Credit Check Personal Loan in Nova Scotia?

Friendly Lender has you covered. Simply submit a quick online application today. You will immediately get connected with online installment lenders across Nova Scotia. Apply online now.