Alberta is the fourth largest Canadian province by land area and the fourth most populous. Alberta’s cost of living is among the lowest in Canada, but that doesn’t mean there aren’t any challenges.

In fact, there is a wide gap between the living wage and the minimum wage in Alberta. The living wage in Alberta varies from $23.70 per hour in Calgary to $32.75 per hour in Canmore. The latter is more than double the minimum wage of $15.00 per hour, which came into effect on April 1, 2024. The long-term trend is of an ever-increasing cost of living throughout Alberta and the rest of Canada.

According to one survey, the vast majority of Albertans (over 60%) say they’re unable to keep up with their expenses.

What Can I Use a Personal Loan for in Alberta?

A personal loan in Alberta can help you cover almost any expense, from rent to utilities, car repairs to vacations, and more. You can use the funds at your discretion. They will be deposited directly into your bank account upon approval.

Regulations for Personal Loans in Alberta

Online lenders in Alberta must follow a number of rules and regulations:

- Must have a business license

- Must provide key loan information

- Must disclose information about optional related products if applicable

- Must provide written or electronic confirmation that optional products have been cancelled if applicable

- Must provide the borrower with information about the loan details during the term of the loan

Prohibited business practices include the following:

- Must not mislead borrowers in loan advertisements, solicitations, or negotiations

- Must not call borrowers before 7 A.M. or after 10 P.M. local time

- Must not contact third parties in relation to a borrower’s debt

These regulations came into effect on January 1, 2019.

What Credit Score Do I Need to Get a Personal Loan in Alberta?

Don’t fret. While major banks will look closely at your credit score and credit report, online lenders do not always do a credit check. At Friendly Lender, we do not perform credit checks as part of our online application process. Just fill out our quick online application and receive an instant response.

You may still wish to know what your credit score is, to know where you stand. Check out Credit Verify – a quick registration will enable you to access your detailed credit report and other useful financial information. Register now!

Who Can Get a Personal Loan in Alberta?

Almost anyone can get a personal loan in Alberta, as long as they can provide a proof of income, a permanent address, and a valid bank account and are a Canadian citizen or permanent resident.

Tips for Getting Approved for a Personal Loan in Alberta

While you can get approved for a loan with a less-than-ideal credit score, there are certain things you can do to tilt the odds in your favour.

- Have a stable source of income

- Have an active Canadian bank account – must have been active for at least 90 days

- Have few or no NSF transactions

- Have a low short-term debt ratio – a low number of active short-term or payday loans

Pros of a Personal Loan

A personal loan can provide you with the following benefits:

- Quick financial relief

- Covering an unforeseen expense or everyday expenses

- Predictable payment schedule

Cons of a Personal Loan

That being said, watch out for the cons as well:

- If you are unable to make your payments, the fees and interest will accrue

- NSF and other fees may be charged

Acceptable Income Sources for Getting a Personal Loan in Alberta

A variety of income sources may be acceptable if you wish to obtain a personal loan in Alberta, such as:

- Employment income

- Self-employment income

- Financial government assistance

How Can I Improve My Finances in Alberta?

One of the best things you can do is increase your income. This can entail learning new skills such as coding or graphic design. All of these skills can be learned online nowadays. All you need is access to a computer and an Internet connection! Many of these skills can be free to learn if you are proactive about finding resources online. Compile a portfolio of your best work along with a polished resume, and you may launch a new, lucrative career in no time!

FAQ

Can I get personal loans no credit check Alberta?

Some private online lenders do not check your credit score or credit report. Here at Friendly Lender, we do not perform credit checks as part of our online application process. Connect with our online installment lenders in an instant.

Should I get a payday loan or a personal loan?

A payday loan is a short-term, high-interest loan. You may need multiple payday loans. This can trap you in a debt-repayment cycle. A personal loan is a single loan that you can repay over a longer period of time at a lower interest rate. In this way, you don’t have to juggle multiple short-term loans and multiple debts.

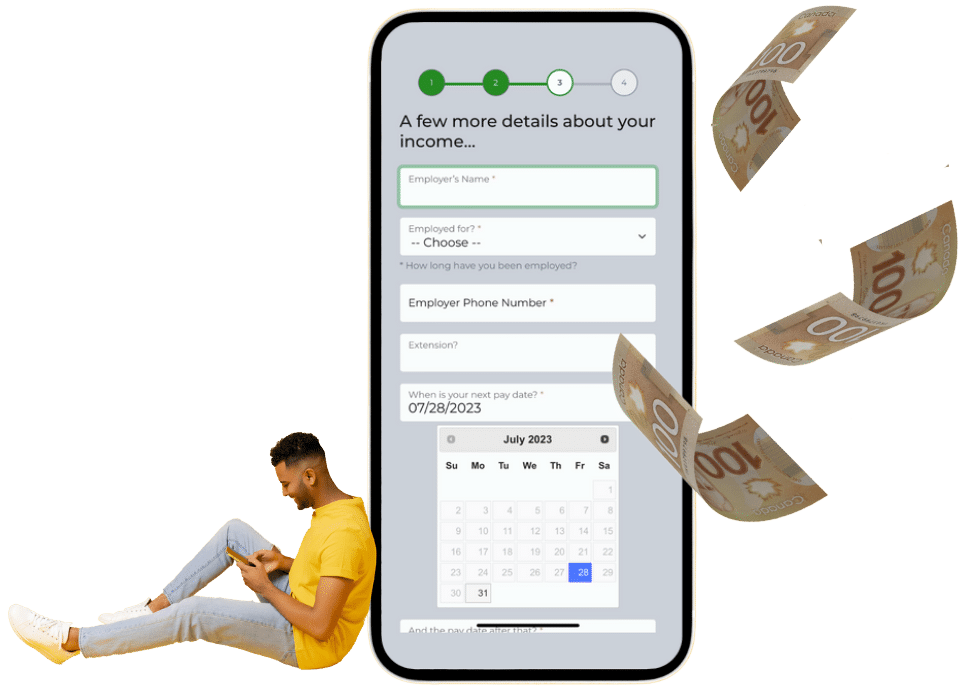

How do I apply for a personal loan in Alberta?

You can submit a quick online application. Click here to apply with Friendly Lender. The application process takes only a few minutes, followed by an immediate response.